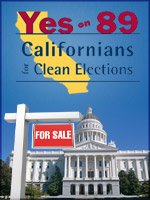

Taking Aim at California Election Funding

Among other changes, Prop. 89 would limit corporate spending -- but not that of tribes and trial lawyers -- on ballot measures.

By Dan Morain

Times Staff Writer

September 26, 2006

SACRAMENTO — A November initiative could dramatically transform California politics, raising taxes to pay for publicly financed campaigns, strictly limiting private giving and taking particular aim at ballot measure spending.

If voters approve Proposition 89 and it withstands court challenges, California will become the first state to restrict spending on ballot measures, though the limits would not apply to two of the biggest players in state politics: trial lawyers and Indian tribes that own casinos.

The initiative's restrictions apply to corporations. Many trial lawyer firms are limited liability partnerships; Indian tribes are governments.

An unlikely coalition has formed to beat the measure. Led by the California Chamber of Commerce, the foes include the California Republican Party, Gov. Arnold Schwarzenegger and groups that in other instances are their fierce rivals: some of the state's most influential unions, including the 300,000-member California Teachers Assn.

The initiative's sponsor is itself a union, albeit a maverick, the California Nurses Assn. The measure's backers include Treasurer Phil Angelides, Schwarzenegger's Democratic challenger; Sen. Barbara Boxer (D-Calif.); and California Common Cause. Out of deference to Angelides, the Democratic Party is neutral, though Chairman Art Torres said the party might challenge one or more aspects of the initiative if it wins.

The 70,000-member nurses union contends that big-spending healthcare companies have stymied its goal of providing broader medical coverage. The union decided to press its proposal after drug companies spent more than $80 million last year to block a labor-backed initiative to curb prescription drug prices.

"When patients get diagnosed and can't afford the prescriptions, there is something wrong," said Rose Ann DeMoro, executive director of the nurses union.

Dubbed the Clean Money and Fair Elections Act of 2006, Proposition 89 is a highly complex measure of more than 50 pages. It would raise corporate and banking taxes by $200 million a year to create public financing for candidates for state office.

It would cap donations to legislative candidates at $500 and to statewide candidates at $1,000; restrict fundraising by the Republican and Democratic parties; and limit single donors to spending no more than $15,000 a year on candidate-related campaigns.

Current law says donors can give $3,300 to a legislative candidate and $22,300 to a candidate for governor per election, but contributors have no overall cap on the money they can give.

All that might be a big enough bite for a single initiative. But the proposed statute goes further. In one of its most far-reaching provisions, Proposition 89 would rein in spending on ballot measures, a dramatic step that even its backers say could be unconstitutional. The backers hope to overturn past court rulings on such limits.

In any election year, propositions consume the most campaign money. Already, more than $100 million has been raised for and against two initiatives on the November ballot, one that would raise oil taxes and another that would raise tobacco taxes.

Proposition 89 would limit direct corporate donations to $10,000 per ballot measure. The limit would extend from public companies such as Chevron to family farms and large private developers such as the Irvine Co. Chevron has spent more than $16.5 million to defeat the oil tax initiative, Proposition 87, on the November ballot.

Union foes contend that labor groups also would be barred from giving more than $10,000 to a ballot measure campaign if they have side businesses, including printing shops and credit unions. The nurses association says unions would not be subject to the limit. Any affected group or business could give more by establishing political action committees and soliciting donations from executives, stockholders and others.

Individuals still could spend unlimited sums on ballot measures. This year, Hollywood producer Stephen L. Bing, scion of a real estate magnate, promoted the oil tax initiative with at least $39 million of his own money.

At least two other major sources of campaign cash — attorneys who represent plaintiffs and wealthy Indian tribes — could continue spending unlimited amounts for and against propositions.

"It amounts to unilateral disarmament," said John Sullivan of the corporate-funded group Californians for Civil Justice Reform, which seeks to limit litigation against business and is a rival of the trial attorneys lobby.

Chamber President Allan Zaremberg denounced Proposition 89 as a "virtual ban on corporate participation in the political process." Democratic consultant Gale Kaufman, who represents the California Teachers Assn., criticized it as "totally gratuitous."

Insurance companies, which often clash with trial attorneys in Sacramento, account for more than half of the $1.3 million raised so far against Proposition 89. The nurses union is Proposition 89's biggest financial supporter, having spent $1.4 million to qualify it for the November ballot and $822,000 on the campaign.

Executives in the nurses union say there was no intention to exempt attorneys or tribes. Rather, their attorneys went as far as they thought they could without clearly violating the Constitution, DeMoro said.

"We don't have a hidden agenda," she said.

Most trial lawyer firms are set up as limited liability partnerships, as are many accountancy and venture capital firms and at least one oil company that is siding with Chevron in opposing the oil tax initiative. Such partnerships would not be bound by restrictions on corporate giving to ballot measures, the initiative's promoters say.

Trial law firms and their organization, the Consumer Attorneys of California, regularly donate more than $1 million a year to state campaigns. The group has not taken a stand on the initiative. But trial lawyers and the California Nurses Assn. have been allies in past campaigns.

In 2004, for example, the two groups fought Proposition 64, which limits lawsuits; it won voter approval. In the June primary, lawyers and nurses also formed an alliance to help fund an $870,000 independent campaign to support and oppose legislative candidates.

Also among the state's biggest spenders on ballot measures are Indian tribes. They have shelled out more than $150 million on propositions since 1998. Like individuals, they could continue to spend unlimited sums on ballot measures, backers of the initiative say.

"Constitutionally, we cannot restrict tribes' spending on ballot measures," said Santa Monica attorney Fredric Woocher, who helped write the initiative.

The U.S. Supreme Court, he noted, has ruled that donors cannot be barred from giving "just because they spend a lot of money."

Woocher's firm has represented the Agua Caliente Band of Cahuilla Indians, which owns two casinos in the Palm Springs area and has spent more than $27 million on state campaigns since 1998. However, Woocher said he wasn't thinking of tribes when he was working on the measure.

Much of Proposition 89 is similar to "clean money" laws in Arizona and Maine. But no other state regulates contributions to ballot measures, in part because the U.S. Supreme Court has struck down past attempts to restrict ballot measure spending.

In addition to hiring Woocher, the nurses retained Richard L. Hasen, a Loyola Law School professor who last year wrote a law review article opining that the issue was "ripe for reexamination in light of the Supreme Court's new-found deference to campaign finance regulation."

"Just look at the amount of money. Corporations have an unlimited playground," said Susan Lerner, executive director of the California Clean Money Campaign, a nonprofit group that is helping to promote Proposition 89.

See the entire article. Click on the title above.

No comments:

Post a Comment