Wednesday, November 29, 2017

Sanders _ The Tax Bill is Immoral

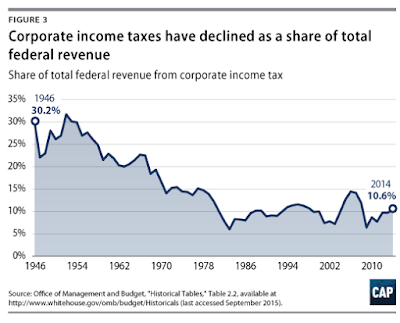

And it will probably not surprise you to learn that just as our tax code benefits the wealthiest people in this country, it also benefits some of the largest and most profitable corporations in the world with a myriad of tax breaks, deductions, credits and other loopholes. As a result, one out of five large profitable corporations today pays nothing in federal taxes.

Labels:

1 %,

corporate,

Koch Brothers,

Republican,

tax,

wealthy

Sunday, November 26, 2017

The Problem With Fake News Is That 'People Want to Consume Information That Makes Them Feel Good, Because It Reaffirms Their Worldview' @alternet

The Problem With Fake News Is That 'People Want to Consume Information That Makes Them Feel Good, Because It Reaffirms Their Worldview' @alternet: Our relationship to information is entirely emotional. A year out from Donald Trump's astonishing and disturbing presidential win, it's become clear that the absolute sea of disinformation — much of which was Russia-funded and most of which was disseminated through the internet — was critical in helping push a know-nothing reality TV star–turned-wannabe-dictator into power. With the 2018 elections less than a year away, the pressing question now is: How we stop this from happening again?

Including fake news about immigrants and immigration.

Including fake news about immigrants and immigration.

Saturday, November 25, 2017

Saturday, November 18, 2017

Trump/GOP Tax Plan is Class War

Bill Barclay

The Trump/GOP “Unified Framework” tax plan has

something for everyone – if by everyone you mean the wealthy, corporate and

non-corporate businesses and the alt-right.

The plan embodies both the neoliberal class warfare that believes poor

people have too much money and rich people have too little money and connects

with the social conservative politics that the Trump and the GOP draws upon to

mobilize its supporters.

Class Warfare: I

Some of the class warfare politics of the Trump/GOP

proposals are obvious; others less so.

The proposal provides a small

tax cut for households in the bottom three quintiles,

ranging from about 0.5 – 1.2% of after tax income in all cases well under the

$1,182/family income boost claimed by Rep. Paul Ryan. At the upper end of the income pyramid, the

story is much different. Over half of the

total tax cuts for individuals will accrue to the top 1% of households,

boosting their after tax incomes by 8.5%. Of course, life can be even better: the

top 0.1% households would grab an average tax cut of almost $750,000, capturing

over 30% of the total tax cuts for families and individuals.

And

Trump has not neglected people like himself.

He – and others in his income and wealth sphere – will gain in three

ways from the changes in the individual income tax. First, the elimination of the alternative

minimum tax (AMT): in 2005, Trump paid $38.4 million on income over $150

million – but without the AMT he would have paid only $7.1

million.

Labels:

class,

class war,

corporations,

Oligarchy,

plutocracy,

Tax plan,

Trump

Thursday, November 16, 2017

Wednesday, November 15, 2017

Schools and Taxes - NEA

Last week, Congressional Republicans unveiled their new tax plan. Students and educators will suffer terribly if the bill becomes law.

This $5 trillion plan is a tax giveaway to the wealthiest and corporations, paid for on the backs of working families and students. It jeopardizes the ability of states and local communities to adequately fund public schools. Nationally, the bill could lead to $250 billion less in public education funding, and nearly 250,000 education jobs put at risk.

Cutting 250,000 jobs takes teachers, guidance counselors, coaches, and administrators out of our schools-the very people who, every day, inspire students to learn, grow, and dream big.

So here's our choice: Fight for the educators, well-rounded curriculum, and support services our students need and deserve; or do nothing, and watch that money go to millionaires and billionaires instead.

Thank you,

The Education Votes Team

P.S. Betsy DeVos loves the Republican tax plan, because in addition to gutting education funding, it also creates a backdoor voucher program exclusively for the wealthy. Call your representative and tell them to oppose this plan.

Labels:

NEA,

public schools,

Republican tax plan,

schools,

taxes

Monday, November 13, 2017

Friday, November 10, 2017

Republican Tax Plan

House Republicans released a tax plan that is a terrible deal for middle-class families and students. They want to rush it through Congress next week, and they want you to pay for it.

The plan is an enormous tax giveaway to corporations and wealthy individuals like Betsy DeVos, and it is funded on the backs of students and hardworking, middle-class people like you. I'm sure you won't be surprised to hear that DeVos has publicly praised the plan.

If Betsy DeVos thinks it is a good plan, then you know something is wrong with it.

That's why we need your help to shut it down. Please send an email to your representative right now.

Labels:

Congress,

NEA,

Republican,

Tax plan

Wednesday, November 08, 2017

Latino Students in California Schools

“The Majority Report:

Supporting the Educational Success of Latino Students in California” provides

an extensive look at how the state’s largest ethnic group is faring at every

level of California’s education system. The report finds that while the over 3

million Latino students in K-12 schools are the majority of California’s 6.2

million K-12 population, and nearly 1 million Latino students are in

California’s public colleges and universities, these students continue to face

troubling inequities from early learning through higher education. California’s

Latino students:

·

Attend the nation’s most segregated schools;

·

Are often tracked away from college-preparatory coursework;

·

Are sometimes perceived as less academically capable than their

White or Asian peers; and

·

Have insufficient access to early childhood education;

·

Are less likely to feel connected to their school environment;

·

Are more likely to be required to take remedial courses at

colleges and universities.

The study also highlights

bright spots throughout the state where promising practices are helping Latino

students advance academically, dispelling the myth that these gaps cannot be

closed, and reiterating the need for more action and urgency from state

leaders.

The Majority Report includes a policy timeline and infographic and is accompanied by

a data tool looking at achievement gaps by county.

Produced by Ed Trust – West. Nov. 2017.

Labels:

achievement,

California,

Ed Trust - West,

Ell,

Latino students

Monday, November 06, 2017

Teachers' Strike Averted

The Sacramento City Unified School District and its teachers union have reached a tentative agreement on a new contract that gives teachers up to an 11 percent raise over the three-year deal and averts a strike for the 43,000-student district.

The deal was finalized Monday after being brokered over the weekend by Mayor Darrell Steinberg, schools Superintendent Jorge Aguilar and the Sacramento City Teachers Association.

The agreement, announced Monday afternoon at City Hall, ended more than a year of bitter contract negotiations and rhetoric between the district and the teachers union. The deal came just two days before the union’s 2,800 members planned to strike.

From the Sacramento Bee

Read more here: http://www.sacbee.com/news/local/article183073406.html#storylink=cpy

Labels:

averted,

Sacramento,

Teachers' strike

Sunday, November 05, 2017

Do Not Cross Teachers' Picket Lines

Note: It is the policy of the College of Education at

CSU Sacramento that student teachers from Sac State will not cross picket lines to replace striking teachers. Working inside a school where the professionals are on strike is not considered a safe nor educationally appropriate environment.

This should also apply to other volunteers in the Sacramento system.

University faculty who supervise student teachers are members of CFA ( NEA, SEIU.) There should be no crossing of picket lines.

Duane Campbell. Professor (emeritus) CSU-Sacramento

See post below on the strike.

To the editor, Sacramento Bee

In the current conflict in SCUSD, the District’s discussion

of the budget and the Bee’s coverage are incomplete and lacking.

Yes, the District has at least $80 million in reserves. The taxpayers passed Prop. 30 and 55 to

adequately fund the schools. Since 2013

the district has received an increase of revenues of more

than $67 million.

First, the professionals in the district deserve respect and

a significant raise in pay. Second, what is missing? Over $10 million per year of this increase is

funded by the state taxpayers under the Local Control Funding Formula. LCFF.

By law, these funds must be spent to improve the education

of children by lowering class size, and focusing on low income, English

Language Learners, foster children, and Special Education. The district has

refused repeated requests to spend the funds as required.

Now, the chickens have come home to roost.

Duane Campbell

Labels:

CTA,

Sac State,

Sacramento teachers,

strike.,

student teachers

Saturday, November 04, 2017

Subscribe to:

Posts (Atom)